The Australian Securities and Investments Commission (ASIC) has released its first 'Investor Alert List', increasing efforts to crack down on illegal financial service platforms and fraudsters. After the list was released, 52 unlicensed entities and 25 websites impersonating legitimate entities were discovered.

Unauthorized and impersonated investment opportunities can cause serious financial and non-financial damage, seriously weakening consumer trust and confidence, "said ASIC Vice Chairman Sarah Court

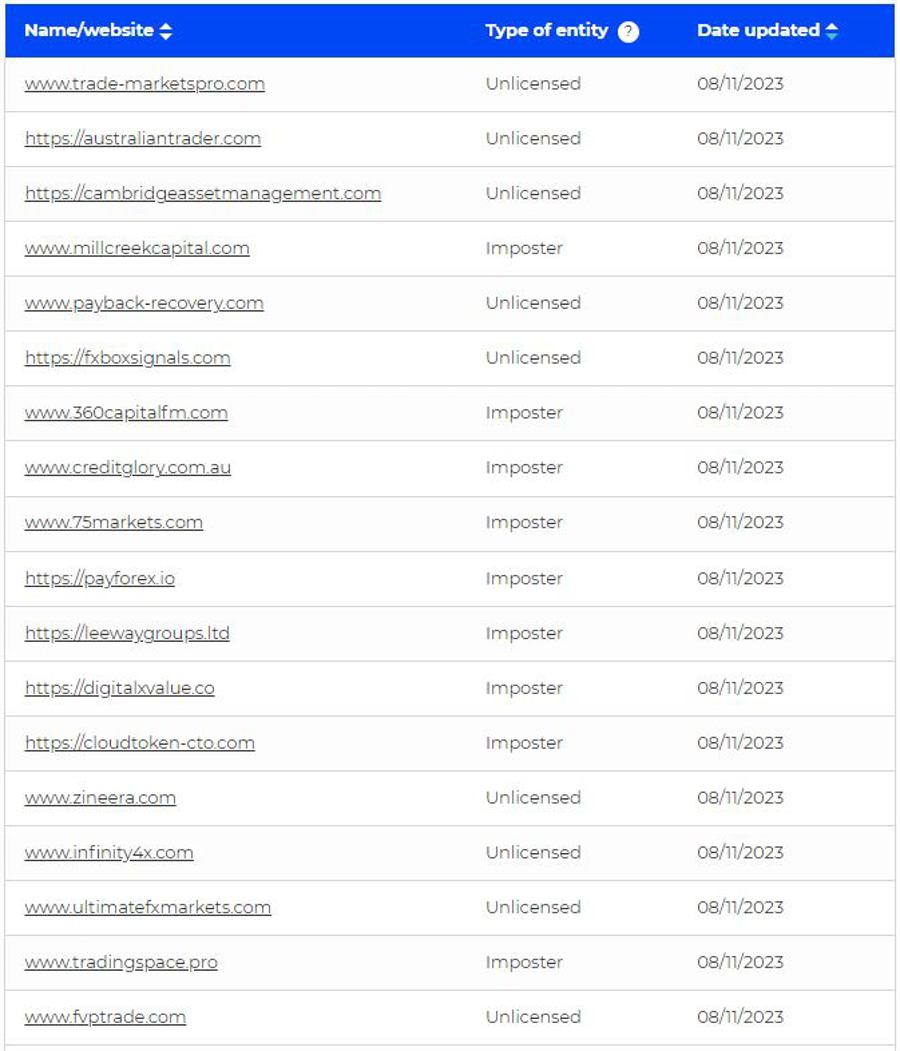

Australian regulatory authorities have released a list of companies with whom you should not deal, which only includes the names of unlicensed companies. The new "Investor Alert List" categorizes entities in two ways: unauthorized entities and impersonating entities. It also added 1256 unlicensed entities from the previous list and marked them as' unlicensed (legacy) '.

The concept of investor alert lists is not new. Several other regulatory agencies worldwide, including the UK, Cyprus, Italy, Spain, and Malaysia, are actively labeling suspicious financial services.

However, maintaining such a list is difficult because fraudsters and scammers often come up with new websites to target victims. ASIC also pointed out that its investor alert list is not exhaustive and emphasized that "some websites or entities may not appear on the list but engage in fraudulent activities that ASIC is not aware of

The Vice Chairman added, "ASIC calls on industries and consumers to report suspicious investment websites to Scamwatch to assist us in identifying suspicious investment websites and assisting us in conducting investigations and taking action

Australian regulatory authorities have created an investor alert list within a week after announcing their actions against over 2500 investment fraud and phishing websites. It has implemented a fraudulent website deletion function, which has deleted 2100 websites since July 2023 and has placed an additional 400 websites in the deletion process.

According to official data from the Australian Competition and Consumer Council, Australians reported a record $3.1 billion in fraud losses in 2022, including $1.5 billion in investment fraud losses. ASIC has since taken these measures to address investment fraud.