The Financial Conduct Authority (FCA) in the UK has released data on company complaints for the first half of 2023.

The complaint data compiled by FCA is reported by over 3000 regulated companies, including complaints filed, closed, and upheld within 6 months, as well as the total amount of compensation paid by enterprises.

According to statistics, FCA Financial Services received a total of 1.88 million registered complaints in the first half of 2023, an increase of 5% compared to the second half of 2022.

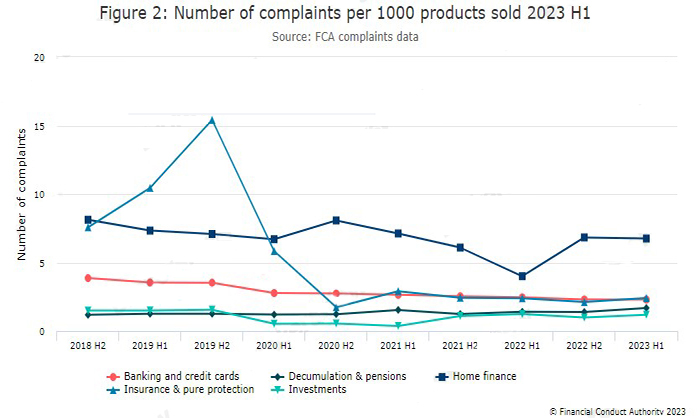

The product categories where the number of complaints has increased include pension and retirement (20%), investment (18%), insurance and pure protection (6%), and bank and credit card (3%).

Meanwhile, the number of registered complaints about housing finance products has decreased by 10%.

Since the second half of 2016, the current account has been the product with the most complaints. The number of registered complaints for this product increased from 500371 in the second half of 2022 to 509923 in the first half of 2023, an increase of approximately 2%.

The FCA publishes complaint data every six months. The FCA believes that a transparent number of company complaints is helpful for both the industry and consumers. For businesses, they can evaluate their performance in the market through comparison, while for consumers, they have additional sources of information to understand companies regulated by the FCA.

Companies that receive 500 or more complaints within six months, as well as companies that receive 1000 or more complaints within a year, are obligated to publish complaint data on their websites. These numbers account for 98% of the total number of FCA complaints. Companies with a complaint count of no more than 500 reported relatively less data.