Future perspective

The first substantial negative line for oil prices in several days indicates a cooling of market sentiment. After the oil price rose and fell on Tuesday night, crude oil continued to decline during the Asian session on Wednesday. In just 24 hours, the oil price fell by $3, indicating a significant fluctuation in the high level. This indicates that the market has accumulated a lot of float after a continuous rise in the past period, and the continuous adjustment demand has triggered profit departure actions, bringing uncertainty to oil price fluctuations. The evening EIA report showed that the crude oil inventory reduction was less than expected, but the diesel inventory reduction far exceeded expectations. The comprehensive inventory reduction in the oil market still pushed the oil price to the high point of the intraday rebound.

But the most significant factor affecting the day was the Federal Reserve's interest rate decision. Although interest rates remained unchanged as scheduled in September, the Federal Reserve also stated that it expected another rate hike before the end of the year if appropriate, and that the rate cut next year would be less than previously expected. Powell emphasized that sustained high energy prices will affect inflation expectations. The Federal Reserve has shifted towards a hawkish stance, causing a sharp rebound in market risk appetite. The US dollar has rebounded significantly, and the stock market, commodities, and other sectors have all retreated. It can be seen that the resurgence of strong oil prices has still affected macroeconomic policies. Recently, major investment banks have shown significant differences in their views on the future market of oil prices. Some are optimistic that oil prices will break through $100, while others are judging that the effect of production cuts has already been priced. The probability of oil prices peaking and falling back in the later stage is high, which also reflects the increasing variables in the future market as oil prices reach high areas.

Overall, due to the tight supply situation being the core influencing factor for oil prices at this stage, there are mostly optimistic views. However, some institutions have also begun to raise warnings about possible changes in the future situation of oil prices. Although the oil price has rapidly rebounded in the short term, it has not shaken the strong pattern of oil prices. Such a sharp drop helps to release adjustment demand, which currently still belongs to the normal scope of technical adjustment. Against the backdrop of continuous inventory reduction, the probability of oil price peaking is not high, and there needs to be a process for investors' emotions and perspectives to shift. Recently, oil prices are prone to significant fluctuations at high levels, so pay attention to the rhythm.

Daily updates

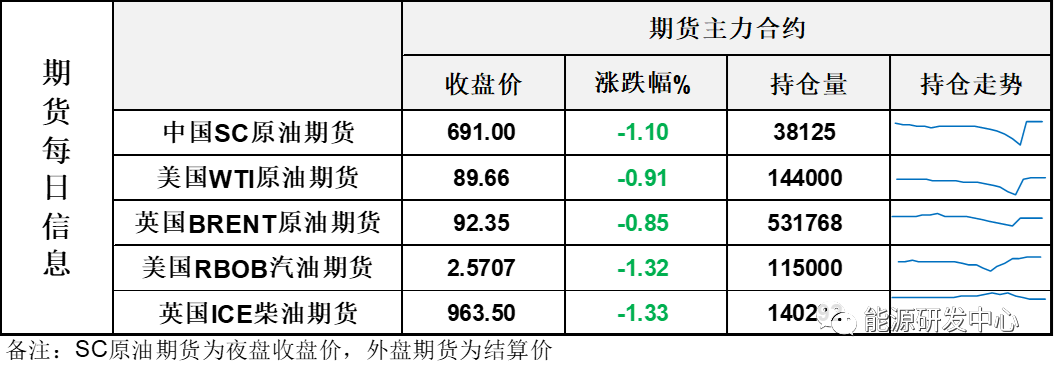

【1】 WTI's main crude oil futures closed down 0.82 US dollars, or 0.91%, at 89.66 US dollars per barrel; Brent's main crude oil futures closed down $0.79, or 0.85%, at $92.35 per barrel; INE crude oil futures closed 1.1% lower at 691 yuan.

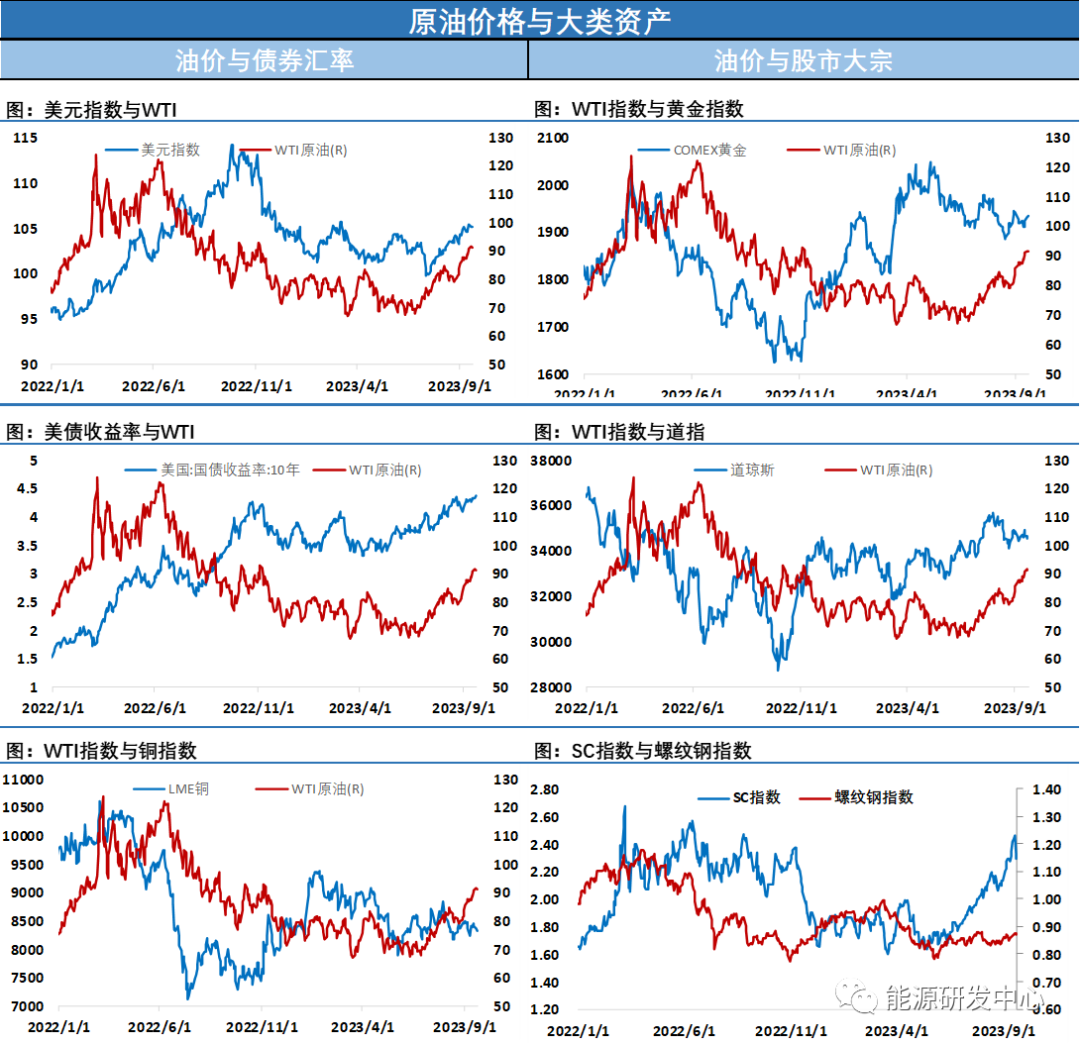

【2】 The US dollar index rose 0.2% to 105.36; The Hong Kong Stock Exchange rose 0.03% against the Chinese yuan to 7.2802; US 10-year treasury bond bonds fell 0.39% to 108.75; The Dow Jones Industrial Average fell 0.22% to 34440.88.

Recent news

【1】 The commercial crude oil inventory in the United States, excluding strategic reserves, decreased by 2.136 million barrels to 418 million barrels, a decrease of 0.51%, and the market expects a decrease of 2.6 million barrels. The strategic oil reserve inventory increased by 600000 barrels to 351.2 million barrels, an increase of 0.17%. As of September 15th, the change in EIA gasoline inventory for the week decreased by 831000 barrels, with an expected decrease of 667000 barrels; Refined oil inventory decreased by 2.867 million barrels, exceeding market expectations. The domestic crude oil production in the United States remained unchanged at 12.9 million barrels per day for the week of September 15th. Excluding strategic reserves, the import of commercial crude oil was 6.517 million barrels per day, a decrease of 1.065 million barrels per day compared to the previous week. Crude oil exports increased by 1.977 million barrels per day to 5.067 million barrels per day. The average four-week supply of crude oil products in the United States was 20.884 million barrels per day, an increase of 6.8% compared to the same period last year.

US crude oil inventories in Cushing, Oklahoma have dropped to their lowest level since July 2022. The strategic oil reserve inventory is the highest since the week of June 9, 2023. The import volume of commercial crude oil from the United States, excluding strategic reserves, was the lowest since the week of July 21, 2023.

【2】 Russian Ministry of Energy: Russia's fuel supply has not been interrupted. The Russian government will soon take measures to curb fuel prices and take "radical" measures to prevent the "gray export" of petroleum products. Previously, there were reports that the Russian government was considering imposing export tariffs of $250 per metric ton on all types of petroleum products from October 1 to June 2024.

Deputy Prime Minister Novak of Russia: It is expected that Russia's oil production will reach 527 million tons this year. So far this year, Russia's natural gas production has reached 41 billion cubic meters, with plans to reach 64.2 billion cubic meters by the end of 2023.

【3】 Goldman Sachs: Raised the forecast for Brent crude oil prices over the next 12 months to $100 per barrel, compared to the previous forecast of $93 per barrel. Assuming that Saudi Arabia gradually lifts the additional 1 million barrels per day production reduction measures starting from the second quarter of 2024, the 1.7 million barrels per day production reduction measures jointly implemented with eight other OPEC+countries will still be fully implemented next year. Most of the upward trend in oil prices has passed, and it is unlikely that oil distribution will continue to exceed $105 per barrel next year. Due to the strong support of OPEC, it is unlikely that the oil price will continue to fall below $80 per barrel next year.