① 22:00 US September NAHB Real Estate Market Index ② Tokyo Stock Exchange in Japan closed for one day due to Elderly Day holiday

01

XAUUSD Gold

Gold daily level, closing at the bullish line. Gold fluctuated upwards last Friday. Shipan gave multiple orders around 1915, and the 1918 position ended hastily. In the evening, Gold went straight to the 1930 front line, feeling like it was missing one billion yuan (see details at the end of the article). Although bulls are relatively strong, there is still resistance defense at the 1932 position of the MA55 daily moving average. If the 1932 first line successfully breaks through, the trend will change to a true bull trend. At the four hour level, since the gold needle bottomed out on Thursday, gold has emerged from a V-shaped reversal pattern relying on the 1901 support level. The short-term moving average system has turned upward, and the MA453 daily moving average above has been strongly suppressed. At the beginning of the week, it was treated as high and low within the range. Today, focus on the resistance of the 1934-1932 front line and the support of the 1915 front line below.

02

XAGUSD Silver

Silver daily line level, reporting on the Yang K line. On Friday, Baiyin launched a long comeback, indicating that there is still strong support on the front line of 22.400, while MACD is facing a downward trend despite its close ties. However, there is still a rebound in demand for silver within the day. At the four hour level, the K-line has been continuously rising with a V-shaped reversal. It bottomed out and rebounded on Thursday, with prices returning above 23.000. Currently, silver prices are operating above the MA10 daily moving average. The MA moving average system has a dead fork downward, and the MACD is initially operating with a golden fork. The red kinetic energy column is gradually increasing, indicating that there is still kinetic energy for the silver short-term rebound. Today, focus on 23.500 line resistance above and 22.700 line support below.

03

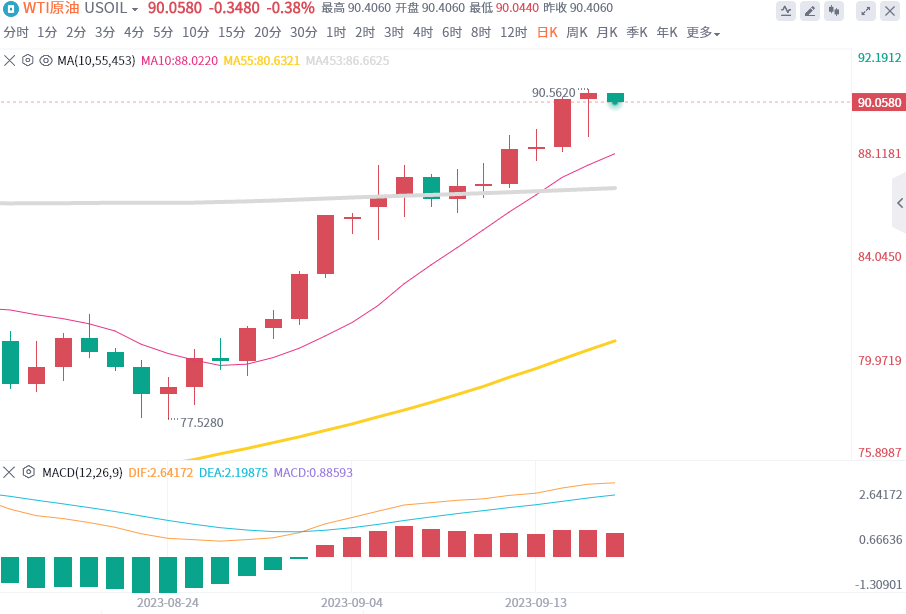

USOUSD crude oil

Crude oil daily level, reported to close at the Yang Hammerhead K line. On Friday, it rebounded and closed positive, with a minimum retest of 88.60 and a stable start, still holding above the 85 integer level. In the late trading session, it rose to recover lost ground and reached a high of 90.56. Be cautious and bullish on the current pace, and wait for digestion before continuing to pursue the bullish trend. At the four hour level, oil prices first fell and then quickly rebounded, showing a pattern of a single positive swallowing the negative K-line. The rhythm is slightly stronger, and there is a further upward trend breaking through the upper track. Today, focus on the front line resistance of 90.50-91.00 and the bottom line support of 89.25-89.00.

04

EURUSD Europe and America

EUR/USD: The upper limit SELL can be set at 1.0690, with a 40 point stop loss protection position, and the target is set at the lower limit of 1.0610.

05

GBPUSD

GBP USD: Can sell at the upper limit of 1.2430, protect position 40 stop loss, and target the lower limit of 1.2340.

06

AUDUSD

AUD/USD: Can be BUY at the lower limit of 0.6410, with a 40 point stop loss protection position and a target of 0.6465 upper limit.

07

USDJPY

USD/JPY: Can be BUY at the lower limit of 147.45, with a 40 point stop loss protection position, with a target of reaching the upper limit of 148.30.

08

USDCAD

USD/CAD: Sell at the upper limit of 1.3550, protect 40 stop loss positions, and target a lower limit of 1.3490.