On Monday (September 11th) in the US market, as the US dollar fell ahead of the release of key US inflation data this week, gold prices rose and briefly broke through 1930, expected to set their best trading day in nearly two weeks. The US dollar remained weak, while gold attempted to stabilize at the 1920 level. The financial calendar was relatively light on this trading day, with a focus on the US CPI inflation report later this week, which will have a significant impact on the Federal Reserve's interest rate path. Gold prices rose on Monday, supported by a pullback in the US dollar, as investors awaited the release of US inflation data, which may determine the interest rate trend of the Federal Reserve. Spot gold maintains a narrow volatility pattern, currently hovering around $1923, with a daily peak of $1930 and a daily fluctuation of around $15. The previous week fell by 1%. Before the release of inflation data in the United States on Wednesday, the US dollar fell sharply, and traders were concerned about whether the world's largest economy had indeed entered a "soft landing" trajectory and whether the Federal Reserve would further raise interest rates.

Key inflation data for the United States will be released this week, with the latest consumer price index on Wednesday and the latest producer price index on Thursday. Prior to the release of these data, a series of stronger than expected economic data last week once again raised concerns about the possibility of the Federal Reserve raising interest rates by more than previously expected. Prior to the Federal Reserve's September 19-20 meeting this month, policymakers had made it clear that they were not in a hurry to raise interest rates, but few of them were prepared to declare victory. This data may prompt traders to adjust their bets on whether the Federal Reserve will further raise interest rates, with CME tools currently showing a 42% probability of raising rates before 2024. The direct reaction of the market to CPI data may be simple. If monthly data is stronger than expected, it may increase the market's hawkish bets on the Federal Reserve and put pressure on gold, while weak data may have the opposite impact on gold's trend and help it achieve a rebound. With the landing of data on non agricultural and unemployment benefits, the rise of the US dollar index has also come to an end. The market is focusing on Wednesday's CPI data. If inflation can effectively decrease, then the Federal Reserve's monetary policy will be more flexible, and the probability of maintaining inflation unchanged will continue to remain stable. However, if inflation does not continue to decline, the Federal Reserve's interest rate resolution next week may once again release some radical views, The short-term US dollar index tends to remain strong and volatile, with a probability of remaining unchanged!

Technical analysis of gold: From a technical analysis perspective, gold previously surged to $1953 and then fell from $1946 to $1915. The current $1915 is a key support, tested multiple times but not broken. From the daily chart, the rebound after a price decline forms a horizontal trend, which is not enough to form a bottom. We all know that a bottom does not rebound, and a rebound is not a bottom. Otherwise, it can only be a relay decline pattern. The moving average system may have a short-term trend of turning heads, but prices are clearly flying up and down. From a historical perspective, there are only two scenarios for this horizontal trend: one is to break the balance with a significant increase in fundamentals, and the other is to trade time for a correction in spatial indicators, and prices will once again open up new short positions, which was also reflected in Friday's high and low. The upward oscillation of the market also follows the 5-day moving average, but the obvious 10 day moving average directly breaks through two medium to long term moving averages, forming a competition for prices between the 5-day and 10 day moving averages, but always suppressed below the 10 day moving average. Therefore, before the daily chart clearly changes direction, continue to pay attention to the situation of breaking the 1915-1930 range, rebound no more than 1930, and temporarily treat it as a potential downward break after weak correction.

From the four hour chart, it can be seen that the gold price has shown a steady rebound trend after reaching support in 1915, with the current suppression level facing the upper part in the 1928-1930 range. Within 4 hours, it entered the small box range and fluctuated, with a slightly longer horizontal time. At the beginning of the week, we still need to wait for the breakthrough of the range to determine the short-term bearish continuation space. The Bulling Road is still tightly closed, considering that the news is concentrated on Wednesday and Thursday, and the two trading days at the beginning of the week may still be fluctuating within the range. In terms of short-term operation, we should first look at the range fluctuation. Currently, it is temporarily under pressure in the 1930 area. However, the upward trend of the US dollar has slowed down, making it difficult for gold to move out of space in the short term. In the 1-hour chart, the BOLL line shows that the market is operating horizontally. However, there have been some temporary signs of stopping the decline in the short cycle, with 1915 being the first level of support in the short term.

The upper short-term focus is on the resistance on the 1936-1933 front line, while the lower short-term focus is on the support on the 1917-1915 front line.

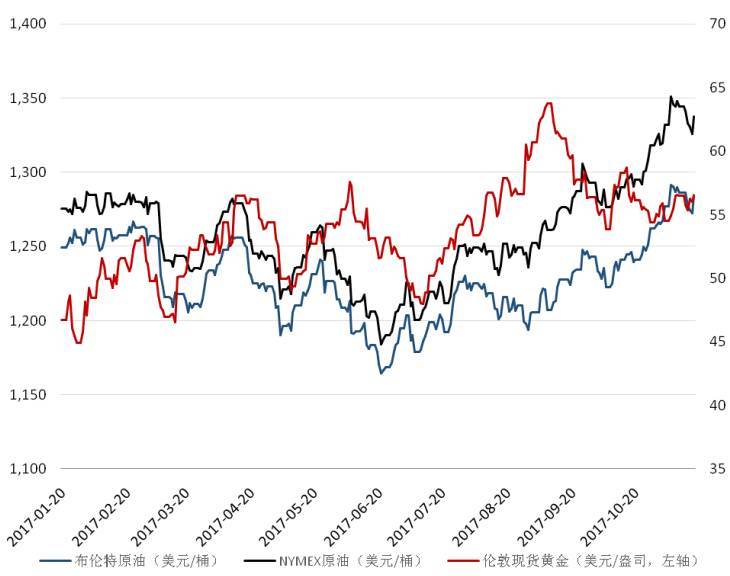

On Monday (September 11th), gold and crude oil prices were trading near $87 per barrel in the US market, and the total US crude oil inventory fell to its lowest level since December 2nd, 2022, as of the week ending September 1st. The cumulative decrease in inventory for the week was 6.307 million barrels, the largest decline since August 25, 2023. According to the Platts Energy survey, Saudi crude oil production has dropped to its lowest level since May 2021, at 8.95 million barrels per day. Russia plans to reduce diesel exports from its key western ports by a quarter this month and retain more supply domestically after seasonal refinery maintenance work, further exacerbating the already restricted fuel market. This news has driven the rise of diesel futures, surpassing the increase in crude oil. And Russia's oil exports are expected to gradually decline in the coming years, accompanied by rising prices? Russian oil exports are expected to decline to 247 million tons in 2023, 240 million tons in 2024, and 248.2 million tons in 2022; The export price of Russian oil in 2024 is expected to rise from $63.4 per barrel in 2023 to $71.3 per barrel. The decline in supply from major crude oil countries is promoting the upward space for crude oil. In addition to supply issues, macroeconomic factors have also had an impact on oil prices. The rise in the US dollar index reflects the strength of the US dollar against a basket of currencies. In addition, the economic data of the eurozone did not meet expectations, with a growth rate of only 0.1% compared to the expected 0.3%, all of which have suppressed the potential demand for crude oil. A strong US dollar typically makes oil prices denominated in US dollars more expensive for traders. Overall, the decisions of Saudi Arabia and Russia, as well as global macroeconomic factors, have had an impact on the oil market, leading to an increase in oil prices and increasing market attention. In the future, investors need to continue to closely monitor these factors to better understand the trends of the oil market.

Technical analysis of crude oil; Last week, crude oil was consolidated on the Xiaoyangxing K-line, but after a surge in volume, it began to pause for consolidation and correction. The spatial contraction was relatively small, but the weekly line is still in an upward structure, with only partial correction. It is also for the bulls to further increase their momentum. In terms of daily trading, the consolidation of the Star K line, which has been going on for five consecutive trading days, is a strong consolidation that leads to a direct upward trend. Without review, it is accompanied by a first step back and then a stable upward trend. This week, pay attention to the changes in the pattern of the first two trading days. There was a slight pause in the four hour chart's three high explorations, but there was little room for retracement. Horizontal consolidation was used instead of retracement correction. The attached indicators have been digested and may be expected to further rise this week. Maintaining a much lower level in operation is the idea. The current critical point is at 85.0, and above this level, there is still a strong consolidation trend.